Program Details

Below is Income and Financial Requirements to determine if you qualify to apply.

Income Requirements

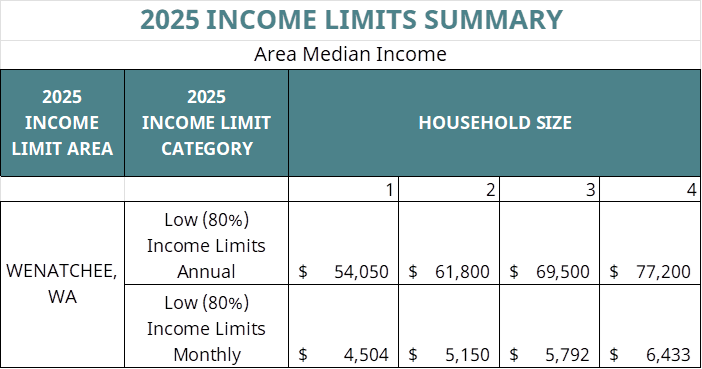

Selected homebuyers must provide verification that their household income is below 80% of Area Median Income.

Selected homebuyers must show 1-year of consistent household income or 2-years of income for self-employed households.

Any selected homebuyer with liquid assets more than $20,000 must use the lesser of the difference between their total assets and the $20,000 threshold or 10% of the Affordable Sale Price for their down payment.

Cannot own any other real estate.

Applicants must be a first-time homebuyer. (Wash. Defines First time homebuyer as not owning a home within the last 3 years)

Finance Requirements

Applicants must be pre-qualified from lender of their choice for the affordable sales price of the home.

Applicants must submit documentation of cash available for 1% of the affordable purchase price available for earnest money, closing costs and home inspections. Please note closing costs may exceed this amount and selected homebuyers will be responsible for those costs by using savings, a matched savings program, or a gift. A lender will provide you with an estimate of closing costs during pre-approval.

No bankruptcy in the past 4-years.

No foreclosure in the past 5-years.

Show past 1-2 years of income.

Your total monthly debt payments (excluding your mortgage) should not exceed 10% of your gross monthly income (before taxes) when you purchase your house. Debt includes your minimum credit card payments as well as any long-term obligations (a repayment period of more than 6 months) such as car payments, child support and student loans.